RFID (radio frequency identification) skimming is a serious threat to anyone with a credit card. Someone can steal your payment information in seconds -- and they can do it from twelve meters away.

To ensure that no one obtains your data, here are some anti-RFID-skimming tips to practice starting today:

RFID Skimming

RFID skimming is when thieves unlawfully retrieve the information written on your card or passport. They use an RFID skimming device or “scanner” that relies on radio waves to retrieve the data that’s embedded into RFID tags. Once they obtain this information, they can use it to commit fraud and identity theft.

Tips to Avoid Card Skimming

#1 Use ATMs in Busy Areas

Thieves usually target ATMs that are in unattended or unlit areas, so it’s best to use a kiosk in a busy street. Make sure that no one else is suspiciously standing next to the machine. RFID scanners can retrieve data at a distance of twelve meters, plus some RFID scanners are as small as a cellphone. If possible, use an ATM that’s inside a bank. Avoid using non-bank ATMs -- these are cash-dispensing machines that can be found in convenience stores, grocery stores, and the like.

#2 Inspect the ATM

Before you take your card out of your bi-fold wallet for men, make sure that the ATM hasn’t been tampered with. This can be tricky since thieves have found a way to inconspicuously fit into the ATM.

Here are some signs of skimming devices you should look out for:

- The card slot looks like it’s about to come off

- PIN pad is raised

- The keys on the PIN pad are loose

- Card slot and PIN pad are scratched

If you’re using your credit card to pay for gas, choose the gas pump that’s closest to the store. Thieves tend to install skimming devices on gas pumps that aren’t within the store attendant’s line of sight.

#3 Keep an Eye on Your Card

Never let your credit card out of your sight. When you leave your credit card with someone else, you run the risk of them sealing your credit card number. If you have to hand over your credit card (e.g. at a restaurant), be mindful of where they’re taking it. If it’s taking them too long to return your credit card, you should make a mental note to check your account as soon as possible. While the risk of waiters or servers committing credit card fraud is low, it has happened. Hence, it can also happen to you.

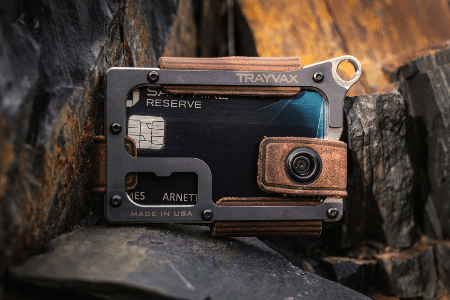

#4 Buy an RFID-Blocking Wallet

Since some RFID skimming devices are as small as a smartphone, they’re extremely easy to hide. That’s why the best way to stop RFID skimming is by buying an RFID-blocking wallet. This type of wallet is made of metal and can block the electromagnetic field that RFID devices need in order to receive data. We recommend the Trayvax Contour Wallet.

It’s a slim front pocket wallet that can carry as many as thirteen cards. If you’re planning on taking a trip, you should upgrade your passport holder to the Trayvax Explorer Passport Wallet. That way, you can protect your cards and passport at the same time.

Other Card Safety Tips

#1 Keep Your PIN a Secret

Remember your PIN but never write it down -- not even on the notes app on your phone. Do not carry a copy of your credit and debit card PIN in your minimalist leather wallet. If you lose your wallet with your PINs in it, your pickpockets can access your account in no time. To resist the temptation of carrying a copy of your PIN, use a slim money clip wallet such as the Trayvax Element Wallet. With this type of wallet, you’ll have room for cards and cash, but definitely not clutter!

#2 Cover Your Pin

When entering your PIN into the ATM, make sure to cover the keypad with one hand. Some thieves install cameras in strategic positions to see the numbers you’re pressing. You should also check the ATM itself to see if there are cameras where they’re not supposed to be.

#3 Regularly Check Your Account

Skimming devices are becoming more and more advanced. To ensure that no one has stolen your information, check your account regularly. Double-check your transactions and report fraudulent purchases as soon as possible. Your bank will temporarily block your card so that the thief can’t make any more purchases.

Conclusion

Eventually, RFID is going to be everywhere. Even if you don’t have an RFID-enabled card, you should start thinking about ways to protect your personal information. Start by shopping for an RFID-blocking wallet at Trayvax. We have a wide selection of slim, simple, and stylish wallets that fit your lifestyle.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.